Why do small businesses need insurance?

Liability claims

Every business, irrespective of its size, faces liability risks. Accusations of causing an injury, property damage or financial loss can come from clients, employees and third parties.

Damage or loss to business premises and equipment

Whether you own a laptop or have business premises with specialist equipment, repair or replacement costs may seriously impact your business without the right insurance.

Contract disputes and unpaid invoices

If you are a small business, you are responsible for creating and fulfilling your own contracts for your services. However, if your client is not satisfied with your work, they may request a refund, ask for additional work or goods to be provided for free, or fail to pay your invoice.

Loss of key personnel

Sometimes, the worst can happen, and you may lose your key staff to an illness. The same applies to you if you’re critical to the business. Several products exist to offer financial help in those circumstances.

What is small business liability insurance?

Small business liability insurance consists of several legal liability products that protect a small business if it is sued.

Business liability insurance provides legal defence and compensates if your business is found liable.

The risks of getting sued arise from business activities and their set-up. For example:

- If you have employees, one of your staff may decide to sue your business for compensation following an injury at work

- dissatisfied client may take you to court to claw back all they’ve paid you and more

- A member of the public may demand you pay their medical bills after tripping on your premises

- You’ve suffered a cyber attack that has negatively impacted your business and clients, resulting in a claim against you.

Professional indemnity insurance for small businesses

Professional indemnity insurance protects small business owners from accusations of professional mistakes, negligence or failing duty of care by unhappy customers.

Many small businesses provide advice or lend their skills to solve customers’ problems. If your work goes wrong and leads to a loss for your customers, they may pursue you for compensation.

It's easy to see how professional indemnity can help with some professions. Suppose an accountant makes a mistake, and their advice leads to a fine from HMRC; there is a clear connection between the professional advice and the loss.

In other professions, the connection is less clear. If a hairdresser recommends a specific treatment or product that goes wrong, in the eyes of the insurance, this could be considered professional advice.

What does professional indemnity insurance for small businesses cover?

Professional Indemnity Insurance offers legal advice, defence and compensation payouts if a customer sues you for professional wrongdoing.

Cover includes:

- Providing the wrong advice or recommendation

- Failing your duty of care

- Making a mistake

- Acting negligently

For example:

- A web developer might be accused of costing a business sales after a website migration, resulting in a loss of traffic

- A personal trainer’s advice has led to a client’s physical injury.

- A property manager forgot to secure a property that got robbed.

- A plumber made a mistake, which led to lots of rework during a property refurbishment.

The list of examples could go on. The risk of something going wrong will depend on your industry, experience and business approach.

It’s important to have client contracts and only delivery services you have experience with. Some professions cannot operate without professional indemnity insurance. If you suffer too many claims, you may become uninsurable.

What professional indemnity limit does a small business need?

The professional indemnity limit you need will reflect your particular business activities. When choosing a limit, consider several factors, including the value of your client contracts, your contractual requirements, and possible financial impacts if your advice goes wrong.

Switching your professional indemnity insurance

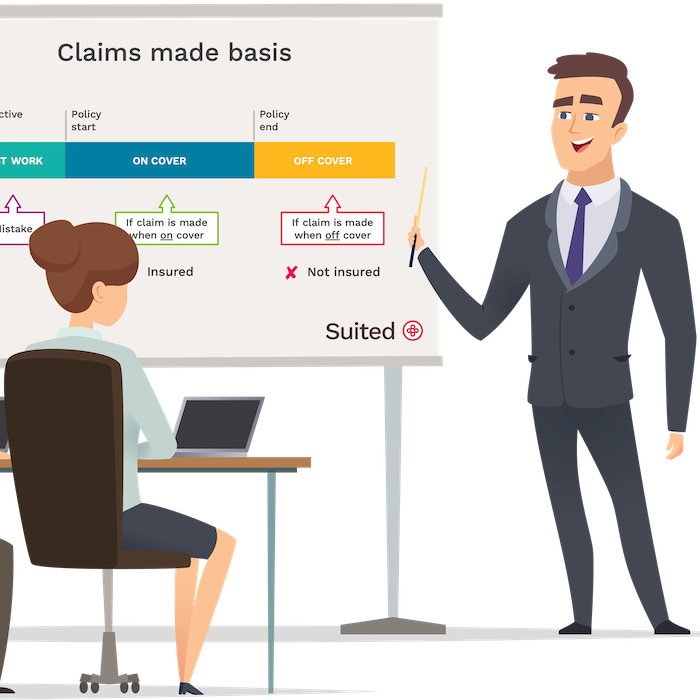

Typically, in the UK, if you cancel a professional indemnity policy, you can no longer claim against it.

Therefore, if you switch your small business insurance provider, be sure your new policy covers your past work; this is called “retroactive cover”.

Should I retain my small business professional indemnity when I retire?

It’s wise to keep your professional indemnity if you’re taking a break or retiring from your business. Claims against professional misconduct can surface months or years after you delivered the work.

Remember: If you cancel your policy, your insurance coverage will end, including coverage for any previous work.

How long you keep your cover in place is up to you. Consider the type of small business you ran and the likelihood that a client might bring a claim against you.

Small business public liability insurance

Public liability insurance protects small business operators from injuries or property damage claims.

Often, small businesses work with clients face-to-face or are open to the public. If an accident happens and it is connected to your business, you may be sued and required to pay compensation.

Public liability is an inexpensive protection against these unfortunate accidents.

What does small business public liability insurance cover?

Public liability insurance covers the legal costs to defend against injury claims and associated compensation demands.

If someone makes a claim against you for causing an accidental injury or property damage or loss, public liability will provide legal defence and pay compensation if you become liable.

Cover includes:

- accidental injury or death

- accidental property damage

For example, you face financial demands because:

- A customer trips and falls over equipment that you left out

- A painter accidentally spills paint on a client's expensive rug, causing damage that requires professional cleaning or replacement.

- An electrician accidentally damages a customer's electrical appliance while working on their property, resulting in the customer claiming the repair or replacement cost.

- A plumber accidentally damages a client's water pipe while fixing another issue, causing water damage to the property and resulting in a compensation claim.

- A landscaper's equipment damages a neighbour's car while working on a project next to the neighbour's property, resulting in a claim for repairing the damage.

Other insurance small businesses buy

The insurance needs of small businesses vary depending on their specific circumstances. It is important to consider factors like affordability of legal disputes, reliance on expensive computer equipment for income, covering business running costs in case of illness, and having employees.

Commercial legal expenses insurance

Most commercial legal expenses insurance will protect small business owners against various tax and legal issues you may encounter due to your profession, which are not covered by professional indemnity or public liability.

At Suited, we combined £100,000 of commercial legal expenses insurance with helplines and other tools to better assist small businesses in dealing with these issues. We call this Business Legal Protect, and it’s part of your subscription.

Business Legal Protect provides qualified advice and assistance with:

- Legal and tax matters concerning your business

- Criminal prosecution

- Compliance & regulation issues

- Unpaid invoices (over £200)

For example:

- HMRC investigations into your tax affairs

- You need legal help chasing a client who has not paid a significant invoice.

- You wish to take a business partner or client to court over a breach of contract.

- You required guidance on compliance or regulatory issues for your business.

Key person insurance for small business owners

As a small business owner, you’re essential to it. Without you, there is no business and possibly your family or those close to you would be left without income.

Life insurance isn’t protection of your life but rather a cash injection for those who rely on you. Many forms of insurance are considered a business expense and can be written off against your profits.

Employers’ liability insurance for small businesses

Most businesses, even the small ones, that engage employees on a full-time, part-time or contract basis must have employers’ liability insurance by law. This also applies to limited companies with more than two directors.

As an employer, you have a responsibility under the law to provide a safe working environment for your workforce. Employers’ liability cover protects you if you’re accused of failing your duty of care.

Directors & officers' liability

As a business owner and director, you have responsibilities in running your business in a specific manner.

Certain parties - investors, mortgage providers, banks, regulators - expect you to do that and might believe you have been negligent.

One of these interested parties could present you with a claim of mismanagement, incorrect conduct, inaccurate facts surrounding your business or saying the wrong thing in the public domain.

D&O, or management liability insurance, protects you from such accusations by providing legal and financial protection against legal action, fines, penalties, and disqualifications, whether paid by the business or you directly.

Premises & equipment business insurance

If you need premises, stock or specific equipment to carry out your business activities, you might need particular business insurance to protect those assets.

Fires, flooding, theft and vandalism aren’t uncommon, and repair or replacement costs could become financially unbearable should the worst happen.

Premises cover protects your stock, goods, fixtures and fittings against physical loss or damage, including theft. Typically, this type of insurance either offers to pay for the repair or replacement or “new for old”.

The landlord usually arranges building insurance if you are renting your business premises. However, commercial building insurance would be essential if you're an owner.

Business equipment insurance

Protecting your more expensive business equipment with insurance could be the difference between being able to carry on with your work or having to over-extend the limit of your credit card to secure another piece of essential equipment.

Business equipment insurance, especially for portable items, can be more expensive but worthwhile, considering if you can’t run your business without some of your gadgets.

Small business interruption insurance

This cover is helpful to businesses that would suffer if they had to close down their business location—places like shops, fitness clubs, health & beauty salons and others.

This could be a consequence of a fire or a burst pipe. You will recover the cost of repairs under your premises insurance, but while you wait for repairs to take place, you may not be able to trade.

You can expect financial help with the loss of revenue your business has suffered and the increased working costs while you get back on track with your business running.

Very few business insurance providers recognise that businesses can suffer just as significant interruption to their operations from being unable to trade online. If you’re an online business, you must check the wording carefully to understand whether it could cover your circumstances.

Business cyber insurance

Cyber insurance is criticism for businesses that operate on the technology industry or deal with a lot of customer data.

However, a business that relies on a website or social media channels might find cyber insurance useful.

A basic cyber cover helps get you up and running again, restoring data and securing your business against further attacks.

More advanced covers will offer a ransom cover and liability if the attack on your business causes harm to your clients or third parties.